Overview

Your Guide to Smooth, Stress-Free Global Deliveries

If you’ve ever shipped products across borders, you know it’s not just about boxing them up and sending them off.

One missing document, a misclassified product, or a forgotten regulation can bring your shipment to a standstill — and cost you time, money, and reputation.

The good news? With the right export compliance checklist, you can turn complex shipping rules into a streamlined, predictable process.

Whether you’re a first-time exporter or a seasoned international trader, this guide will walk you through the must-have steps for hassle-free, compliant shipping.

Why Export Compliance Matters

Export compliance isn’t just “red tape.” It protects national security, ensures trade fairness, and keeps you in good standing with customs authorities worldwide.

Skipping compliance can lead to:

- Shipment delays (sometimes weeks or months)

- Fines & penalties (in some cases, six figures or more)

- Loss of export privileges

- Damaged customer relationships

In short: Compliance is your passport to smooth global trade.

The Hassle-Free Shipping Export Compliance Checklist

Think of this checklist as your pre-flight safety inspection for exports. Complete every step before your shipment leaves the warehouse.

1. Verify Export Licenses & Permits

- Check if your product requires an export license under your country’s regulations.

- In the US, consult the Bureau of Industry and Security (BIS); in India, refer to DGFT guidelines.

- Certain goods — like high-tech electronics, dual-use products, or pharmaceuticals — often require special clearance.

- Pro Tip:

Keep a master list of your SKUs with their license requirements so you don’t have to start from scratch each time.

2. Correctly Classify Your Goods

- Assign the correct HS Code (Harmonized System Code) to every product.

This determines duties, tariffs, and whether your product is restricted. - Check the Schedule B for US exports or your local customs database.

Why it matters:

A wrong HS code can result in overpayment of duties or shipment seizure.

3. Screen All Parties

- Use Denied Party Lists (DPL) or Restricted Party Screening tools to ensure your buyers, intermediaries, and suppliers are not banned from trade.

- This includes customers, freight forwarders, and even end users.

Example:

Selling to a sanctioned entity — even unknowingly — can result in heavy penalties.

4. Prepare Accurate Commercial Documents

Essential documents include:

- Commercial Invoice (with detailed product description, HS code, and value)

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin (if required)

- Insurance Certificate

Pro Tip:

Always ensure descriptions match across all documents. Even a minor mismatch can raise red flags at customs.

5. Check Trade Agreements & Tariffs

- Take advantage of Free Trade Agreements (FTAs) to reduce or eliminate tariffs.

- Example: Under the India-UAE CEPA Agreement, certain goods enjoy zero-duty benefits.

Action Step:

Coordinate with your freight forwarder to apply for preferential duty rates where applicable.

6. Comply with Destination Country Regulations

- Check if your product meets local safety, labelling, or packaging laws in the destination country.

- Example: The EU has strict CE marking requirements; the US has FDA rules for food and cosmetics.

7. Ensure Proper Packaging & Labelling

- Follow ISPM-15 rules for wood packaging materials.

- Label fragile, perishable, or hazardous items clearly in the required language(s).

8. Arrange Insurance

- Cover your shipment against loss, theft, or damage in transit.

- Choose between CIF (Cost, Insurance, and Freight) or FOB (Free on Board) depending on your Incoterms.

9. Choose the Right Incoterms

- Decide who pays for what, and where risk transfers from seller to buyer.

- Popular Incoterms: EXW, FOB, CIF, DDP.

10. Keep Compliance Records

- Maintain records of export transactions, licenses, and communications for at least 5 years (varies by country).

Export Compliance Steps & Risks

Step | Compliance Action | Risk if ignored |

Export Licensing | Verify if your goods need permits | Heavy fines, shipment confiscation |

Product Classification | Assign correct HS code | Duty overpayment, customs seizure |

Party Screening | Check all entities in supply chain | Legal penalties, export bans |

Documentation | Prepare accurate paperwork | Delays, fines, rejection at port |

Tariff Optimization | Use FTAs & trade agreements | Higher costs, lost competitiveness |

Destination Rules | Comply with local standards | Market entry refusal |

Packaging & Labelling | Follow international rules | Damage, rejection at customs |

Insurance | Cover shipment risks | Financial loss from damage |

Incoterms | Define terms clearly | Disputes, unexpected costs |

Record Keeping | Archive all compliance files | Audit failures, legal trouble |

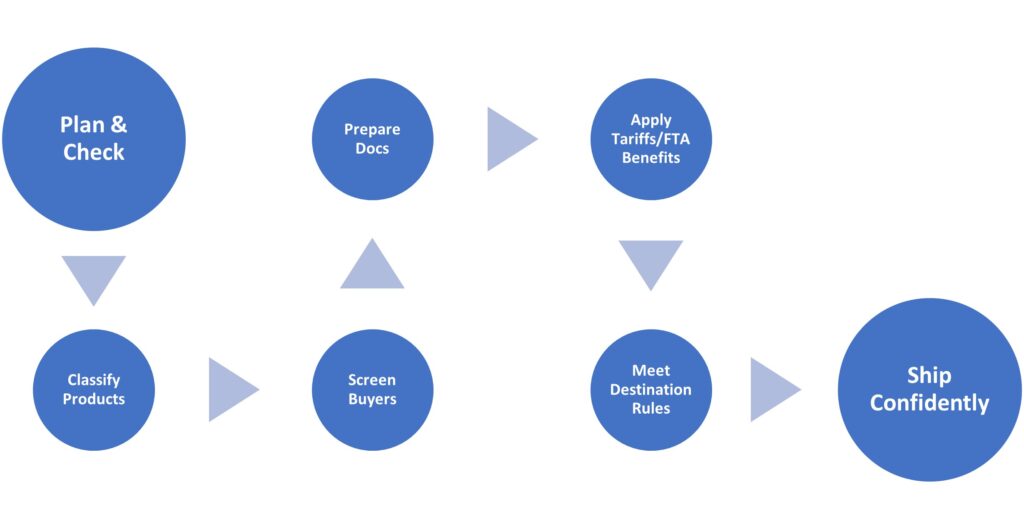

Visual Snapshot: Compliance Journey

Final Thoughts

Exporting isn’t just about moving products — it’s about building trust and reliability across borders.

A compliance error can undo months of business development, but a solid export compliance checklist can make your shipping process predictable, cost-efficient, and stress-free.

So, before you send that next container or courier parcel abroad, run through your checklist — your future self (and your customers) will thank you.